Probate is the legal process by which a court approves and enacts your will. It may be in your best interest to seek the help of an experienced attorney and financial advisor to make sure all your “i’s” are dotted and your “t’s” are crossed. Correctly creating a trust can be difficult, especially if you have a complex estate. But don’t just opt for the cheaper option. Others seek the assistance of a lawyer and easily drop more than $1,000. Some people do it with a few hundred dollars using online programs. The cost of creating a living trust in Missouri can vary widely, depending on several factors. How Much Does It Cost to Create a Living Trust in Missouri?

Based on distinct factors such as your personal tax situation and marital status, it may behoove you to transfer certain investments and not others. If your estate is large or complicated, a financial advisor can help you determine which assets ought to be transferred into a trust. One major exception, though, comes with individual retirement accounts (IRAs), which must be in the name of an individual. Investments like stocks, bonds and mutual fundsĪs you can see, a revocable trust can hold just about any type of investment.Bank deposits like savings, money market and checking accounts.If your trust is meant to provide for someone who is disabled or pay for, say, your grandchildren’s educations, the trustee will manage the assets for as long as necessary.Ī revocable living trust can hold various types of assets and physical property including: You can designate yourself as the trustee, but in that case, you’ll also need to name a successor trustee for when you die. The trust grantor names a trustee to manage the assets in the trust. The main purpose of a living trust is to avoid probate, the court process for distributing assets according to a will – or state law if there is no will. Unlike a will, it also is an entity that holds the estate while you – the owner and trust grantor – are alive. What Is a Living Trust?Ī living trust is a legal document which establishes who will receive your assets and property when you die. A lawyer or financial advisor can help you with this.

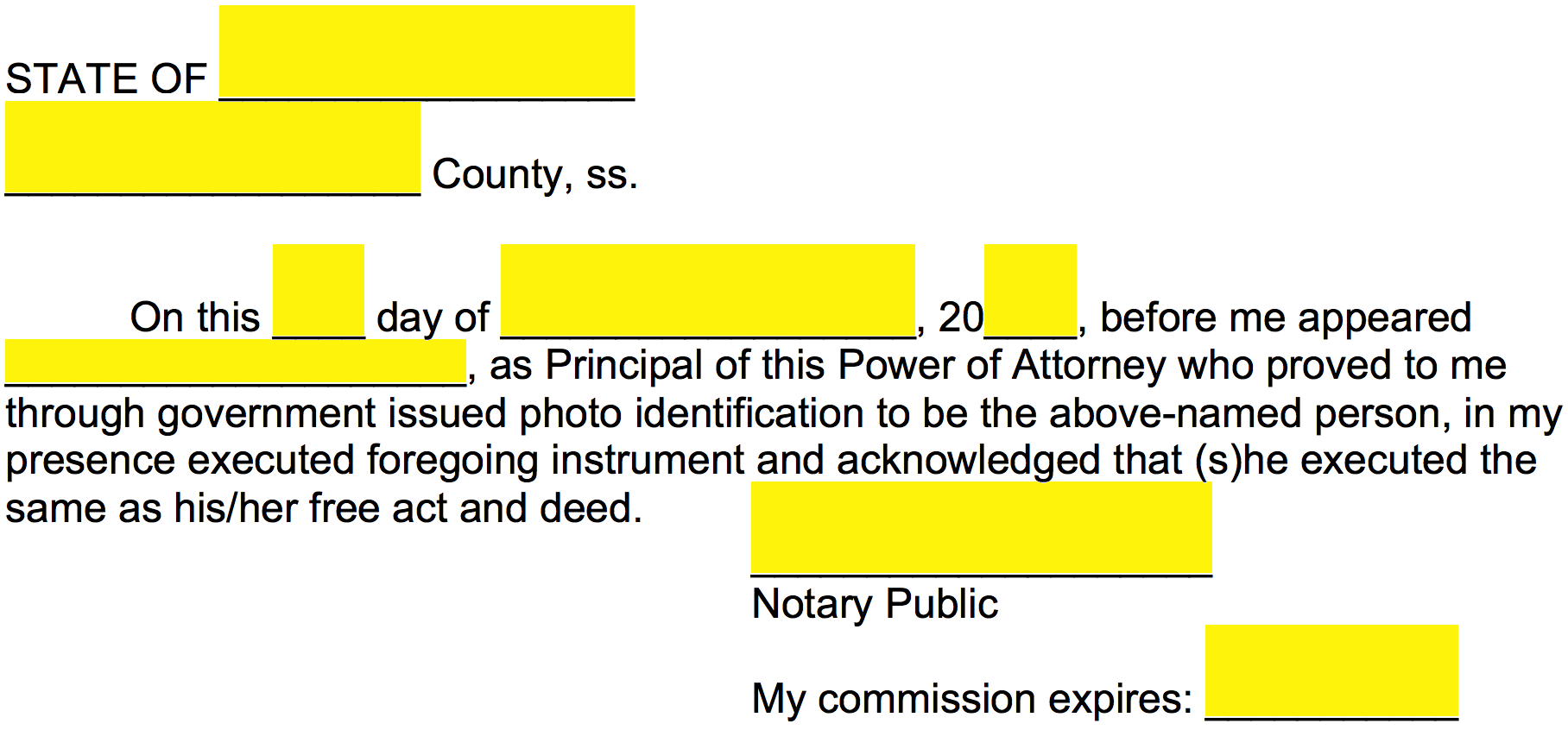

Sign trust agreement in front of a public notary.įund the trust by retitling assets to the trust’s name.

#Does a will have to be notarized in missouri software

If you make yourself the trustee, you must also designate a successor trustee who will take control of the trust when you die.Ĭreate the trust document by using software or hiring an attorney. This person has the responsibility to manage your trust assets. That said, as long as you are creating a trust, you may decide to simplify things by putting everything in it. But things like bank accounts and life insurance policies do not need to go into a trust, since you can avoid probate by simply telling the bank and life insurance company who your beneficiaries are (those accounts are payable or transferable on death). Take stock of your assets and determine which ones you want to put in the trust. Chances are you want a revocable one, since it allows you to maintain control of your assets – and cancel the trust if you need the assets, after all. You also need to decide between a revocable or irrevocable trust. You can either establish a single living trust or a joint one with your spouse. To create a living trust in Missouri, take the following steps:Ĭhoose the type of trust.

0 kommentar(er)

0 kommentar(er)